The Term Used to Describe an Unsecured or Non-collateralized Bond.

The term used to describe an unsecured or non-collateralized bond. The term used to describe an unsecured or non-collateralized bond.

Introduction To Asset Backed And Mortgage Backed Securities Mortgage Estimator Mortgage Payoff Mortgage

The term used to describe an unsecured or non-collateralized bond.

. The monthly payment principle and interest is 32224. Variable-rate demand obligation VRDO. At the time the bonds face value ie the principal amount must.

Collateral trust bonds also use securities to secure their debts. Investment grade bond The term applied to bonds that are judged by their rating agency as being likely to pay their interest and maturity obligations. Describe secured debt unsecured debt and credit enhancements for corporate bonds.

The term used to describe an unsecured or non-collateralized bond. The term used to describe an unsecured or non-collateralized bond. Investment grade bond A bond that has been judged by credit rating agencies as having a relatively low probability of default on the payment of its interest and maturity payment.

The only thing that provides security for the lender is your credit worthiness which is usually determined by your credit score and credit history. Summarize the bankruptcy process and bondholder rights. An unsecured loan is a loan that has no collateral as backing for the loan.

A finance and accounting term used to describe the net amount of cash generated by a firms operations. This is unsecured debt meaning no collateral exists to guarantee at least a portion. A general term used to describe either the practice or the result of creating securities by repackaging cash flows from financial contracts.

For example if you take out a loan to buy a car the car serves as collateral for the loan so if you stop paying on the loan the lender can seize your car and sell it to pay off your loan. The securities pledged by the bond issuer are held by a trustee. A term bond refers to a bond that matures on a single specific date in the future.

Unsecured short-term promissory notes issued by. A type of bond that allows the bond issuer to retain the privilege of Current yield redeeming it at a pre-specified price at some time prior to its normal maturity date. 7733760 - 40000 3733760.

Investment-Grade bond The term applied to bonds that are judged by their rating agency as being likely to pay their interest and maturity obligations. A loan is obtained for 40000 with a term of 20 years. Bonds in this category are often referred to as debentures.

The term used to describe an unsecured or non-collateralized bond Investment-grade Bond a bond that has been judged by credit rating agencies as having a relatively low profitability of default on the payment of its interest and maturity payment. A secured bond is a type of investment in debt that is secured by a specific asset owned by the issuer. Collateralized bond obligation CBO.

The term applied to bonds that are judged by their rating agency as being likely to pay their interest and maturity obligations Atype of municipal bond whose interest and maturity payments are paid using funds generated by the project being financed Cmdo It Now Santa. Learn more about the differences between secured and unsecured loans. Or the lender may require that you use an asset as security for the loan.

This is unsecured debt meaning no collateral exists to guarantee at least a portion. The asset serves as collateral for. Describe a medium-term note and explain the differences between a corporate bond and a medium-term note.

A collateral trust bond is a type of secured bond in which a corporation deposits stocks bonds or other securities with a trustee so as. 20 yrs X 12 mo 240 months2. Bonds in this category are often referred to as debentures.

This involves the use of a lien which is a legal claim allowing a lender to dispose of the assets of a business that is in default on a loan. Examples include MBSs CMOs ABSs and CDOs. Bonds in this category are often referred to as debentures.

Callable bonds D B. Invoices are one of the types of collateral used by small businesses wherein invoices to customers of the business that are still outstanding unpaid are used as collateral. Certain types of investments pledge equipment to.

List the factors considered by rating agencies in assigning a credit rating to corporate debt. Such unsecured bonds only have the issuers. A long-term bond the interest rate of which is adjusted periodically typically based upon specific market indicators.

The term used to describe an unsecured or non-collateralized bond investment grade bond a bond that has been judged by credit rating agencies as having a relatively low probability of default on the payment of its interest and maturity payment. In traditional and over-simplified usage cash flow is defined as the sum of net income after tax plus all noncash expenses such as depreciation. X 240 months 77337603.

A bond that is not secured by collateral. An unsecured debt instrument like a bond is backed only by the reliability and credit of the issuing entity so it carries a higher level of risk than a. What is the total amount of interest paid on the loan at the end of the term.

Difference Between Secured And Unsecured Bonds

Introduction To Collateralized Debt Obligations

Deals Of Loan Is Known For Its Special Offers For Personal Loans And Often Said As The Best Personal Loan Providers In P Personal Loans Financial Services Loan

Collateralized Debt Obligation Definition Structure Advantages

Introduction To Collateralized Debt Obligations

Introduction To Collateralized Debt Obligations

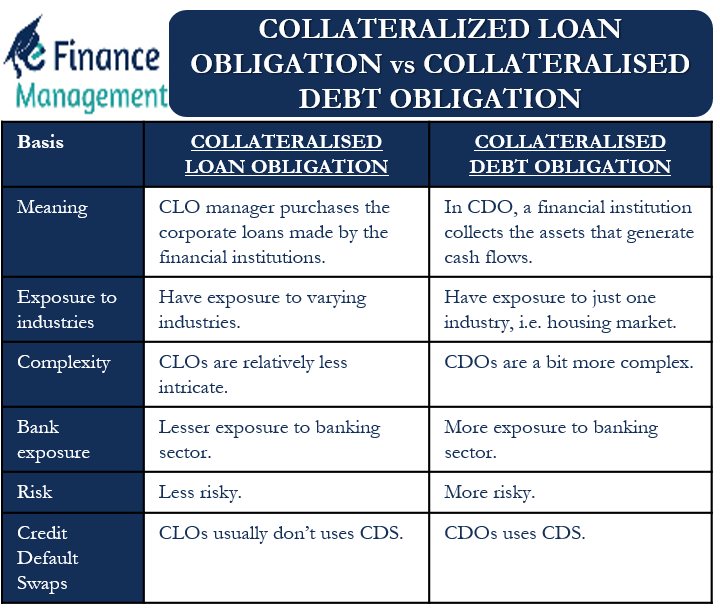

Clo Vs Cdo What Are They Differences Banking Crisis Efm

Solved Callable Bonds Current Yield Coupon Term Loan Chegg Com

Collateral Debt Obligation Criticism Of Collateralized Debt Obligations

Secured Bond Definition Types How It Works

N Csrs 1 F8285d1 Htm N Csrs United

Senior Debt Vs Corporate Bonds Pros Cons Comparison

Solved The Problems Of Air And Water Pollution Focus On The Chegg Com

Line Of Credit Loc Definition Types Examples

Solved Question 2 Treasury Bills Are What Type Of Debt Chegg Com

Secured Vs Unsecured Bonds Sofi

Collateralized Debt Obligations Cdo Step By Step Guide To How It Works

Comments

Post a Comment